What is a credit card decline?

A credit card decline occurs if, for a particular reason, a credit card payment cannot be processed. The transaction is declined by the payment gateway, the processor, or the issuing bank.

How should you handle a declined credit card?

- Stay calm.

- Do a quick review to see if you’ve mistakenly entered information incorrectly.

- Ask the customer for an alternative form of payment.

- Don’t accept an authorization number from the customer or their bank. The authorization must be obtained through your processing device.

If you suspect fraud, call 800.563.5981, select option 4 and follow the prompts to speak with a trained agent for a suspicious card.

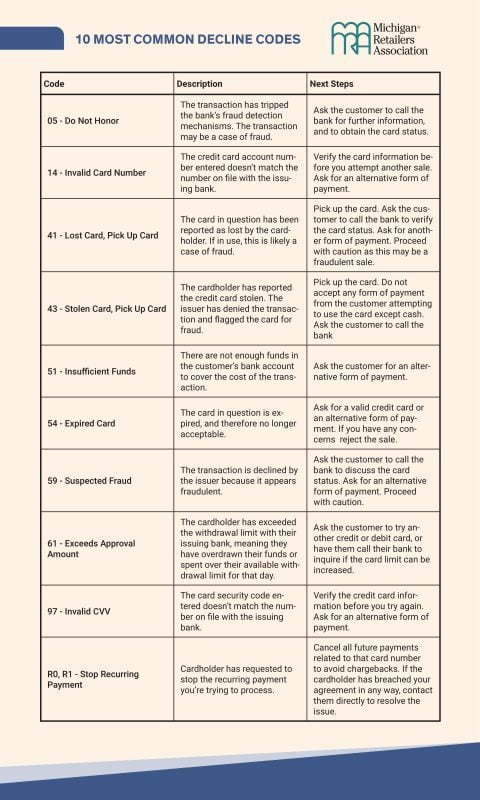

Most Common Decline Codes

The transaction has tripped the bank’s fraud detection mechanisms. The transaction may be a case of fraud.

- Ask the customer to call the bank for further information, and to obtain the card status.

The credit card account number entered doesn’t match the number on file with the issuing bank.

- Verify the card information before you attempt another sale. Ask for an alternative form of payment.

The card in question has been reported as lost by the cardholder. If in use, this is likely a case of fraud.

- Pick up the card. Ask the customer to call the bank to verify the card status. Ask for another form of payment. Proceed with caution as this may be a fraudulent sale

The cardholder has reported the credit card stolen. The issuer has denied the transaction and flagged the card for fraud.

- Pick up the card. Do not accept any form of payment from the customer attempting to use the card except cash. Ask the customer to call the bank.

There are not enough funds in the customer’s bank account to cover the cost of the transaction.

- Ask the customer for an alternative form of payment.

The card in question is expired, and therefore no longer acceptable.

- Ask for a valid credit card or an alternative form of payment. If you have any concerns reject the sale.

The transaction is declined by the issuer because it appears fraudulent.

- Ask the customer to call the bank to discuss the card status. Ask for an alternative form of payment. Proceed with caution.

The cardholder has exceeded the withdrawal limit with their issuing bank, meaning they have overdrawn their funds or spent over their available withdrawal limit for that day.

- Ask the customer to try another credit or debit card, or have them call their bank to inquire if the card limit can be increased.

The card security code entered doesn’t match the number on file with the issuing bank.

- Verify the credit card information before you try again. Ask for an alternative form of payment.

Cardholder has requested to stop the recurring payment you’re trying to process.

- Cancel all future payments related to that card number to avoid chargebacks. If the cardholder has breached your agreement in any way, contact them directly to resolve the issue.

Additional Resources

Download/Print/Display the most common decline codes in your store.

Getting a different code, view this complete list of credit card decline codes.

If you have questions regarding credit card processing, contact our customer service team at customerservice@retailers.com or 800.563.5981, option 2.