Possible income tax cut or repeal at top of House priorities

The new 99th legislature is more conservative than the previous one, a fact evident in some of the top priorities already identified. At the top of the House’s list appears to be serious consideration of lowering or repealing Michigan’s personal income tax. The Senate, meanwhile, is focused once again on repealing the state’s prevailing wage law.

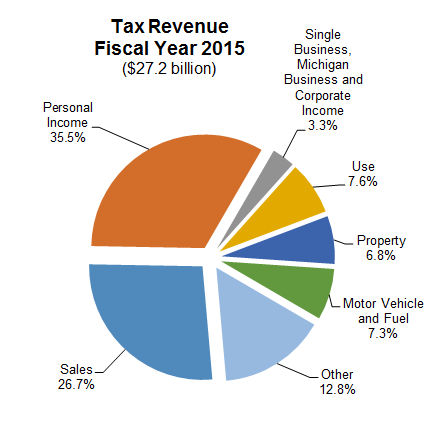

Currently, Michigan’s personal income tax rate is 4.25%. The rate was lowered in October 2012 from 4.35%. Legislators hope to consider lowering the rate to 3.9%, and some believe the tax should be eliminated entirely. The tax generates approximately $8 billion in revenue annually.

Michigan has one of the lower personal income tax rates compared to all 50 states. In the Great Lakes region, Indiana, Illinois and Pennsylvania have a lower personal income tax rate than Michigan. Seven states do not levy a personal income tax. If a reduction or elimination is seriously considered, MRA has potential concerns over how the lost revenue would be replaced. Some states without a personal income tax have a higher sales tax. Filling an $8 billion hole could mean a state sales tax as high as 13% – a retail sales killer.

(The tax revenue graphic at the top left was accessed from the State Budget Office website.)

House announces committees, MRA meets with new legislators

The House finally announced legislative committees on January 26 and which legislators will serve on each. A full list of the committees and their members is available on the House website and Senate website. Retail is a very diverse industry and, accordingly, MRA tracks legislation before nearly all of the various legislative committees. Every two years in the House and every four years in the Senate, the legislative and committee makeup changes and MRA works to bring the newly elected legislators up to speed on retail issues. There are 43 new faces in the Michigan House this term. MRA meets with each legislator individually and has already met with 27 of the new representatives and several of the newly appointed committee chairmen.

AG issues pro-retail opinion on Ann Arbor ‘Tobacco 21’ ordinance

Attorney General Bill Schuette issued a pro-retail opinion yesterday on the legality of Ann Arbor’s “Tobacco 21” ordinance. The ordinance went into effect on January 1 and prohibits sales of tobacco products to persons under 21. The opinion agrees with retailers that state law pre-empts the ordinance, and only the legislature may change the legal purchase age.

The opinion, numbered 7294, finds that the Age of Majority Act pre-empts a city ordinance that provides “a person shall not sell, give or furnish a tobacco product in any form to a person under 21 years of age.” The ordinance directly conflicts with state law, since the Age of Majority Act prohibits treating these young adults ages 18-20 differently from persons 21 years and older with respect to their legal capacity to purchase tobacco products.

The opinion was requested by Senator Rick Jones (R-Grand Ledge), chairman of the Senate Judiciary Committee and sponsor of legislation last term that would have pre-empted the ordinance. MRA had suggested that the senator request an opinion in addition to his legislation. The opinion should be published online soon and will be available on the AG Opinion page.

Out-of-state wine retailer files suit over direct shipment ban

As expected, an out-of-state wine retailer filed a lawsuit against the State of Michigan over a new law that prohibits him from shipping wine to Michigan consumers. Indiana-based retailer Lebamoff Enterprises filed suit in the U.S. District Court in Detroit and was joined by three Michigan consumers. Public Act 520 of 2016 allows Michigan-based retailers to use third parties to deliver wine, beer and spirits. The law removed language that previously allowed an out-of-state retailer that holds a license substantially similar to a Michigan Specialty Designated Merchant (SDM) license to use a third party to deliver beer or wine in Michigan. The lawsuit claims that PA 520 of 2016 violates the Commerce Clause because it treats interstate sales less favorably than intrastate sales and also violates the Privileges and Immunities Clause of the U.S. Constitution.

Other important items to note:

GROCERY/CONVENIENCE

- Liquor license locations: Legislation that would add a new minimum 2,640-foot distance between Specialty Designated Distributor (liquor) licensed establishments was introduced as HB 4079 on January 24. The bill would not apply to current licensed establishments or to applicants that purchase less than $52,000 in spirits from the commission annually, also have a Class B Hotel or Class A Hotel license, is separated by a major thoroughfare, or is a retail food store with an existing Specialty Designated Merchant license that is larger than 20,000 square feet and is located in a neighborhood shopping center. The bill was referred to the House Regulatory Reform Committee.

- Sales of e-cigarettes to minors: Legislation prohibiting the sale of e-cigarettes or devices that provide vapor nicotine to minors was introduced as SB 37 on January 18. The bill was referred to the Senate Regulatory Reform Committee.

- Tobacco sales to minors: Legislation introduced on Tuesday would increase penalties for selling tobacco products to a minor, from $50 to $100 for a first violation and $500 for a second or subsequent violation. The bill, SB 74, is a reintroduction of a bill from last term that the Senate approved but the House never took up. The bill was referred to the Senate Judiciary Committee and will likely be taken up for a hearing soon.

LABOR

- Use of credit in hiring: HB 4112 would prohibit the use of an individual’s credit history in the hiring process. The bill was introduced on May 26 and referred to the House Commerce and Trade Committee.

PHARMACY

- MAPS exemption: SB 47 would require the Department of Health and Human Services to promulgate rules using MAPS reports to track the dispensing of opioid antagonists. Emergency departments, hospitals, hospice centers and oncology centers would be exempt from the reporting requirements. The bill was introduced and referred to the Senate Health Policy Committee on January 18.

- Opioid insurance coverage: Legislation to require insurance companies to offer coverage for at least one abuse-deterrent opioid pain reliever was introduced as HB 4074 on January 24. The bill was referred to the House Insurance Committee.

REGULATIONS

- Fireworks: Legislation to prohibit the sale and use of consumer fireworks in densely populated areas unless the local government allows it by ordinance was introduced as HB 4044 on January 18. The bill was referred to the House Regulatory Reform Committee.

- Fuel pricing differences: HB 4139, introduced on Wednesday, would amend the Consumer Protection Act to prohibit charging a higher price or fee than is posted on the premises or fuel pump on sales of fuel based on the use of credit card. The legislation is a reintroduction of a similar bill from last term and was referred to the House Commerce and Trade Committee.

- Money order notification: A bill to require retailers and other entities that issue money orders and cash checks to post a schedule of rates and fees was reintroduced on January 25 as HB 4087. The legislation was referred to the House Financial Services Committee and would require each location that offers money transmission services to post a sign, in boldface type size 36 or larger and in a place visible to the public, listing the rates and fees for its services. MRA worked to stop similar legislation last term, since fees for money transfers vary greatly. Interestingly, the legislation would not likely impact most retailers, since the bill amends the Money Transmission Services Act, which only applies to entities licensed as a money transmitter in Michigan.

- Secondhand dealer regulations: Legislation introduced as HB 4107 last week would amend the current secondhand dealer law to apply to townships as well as counties, cities and villages. MRA has been working on changes to the Act to remove onerous requirements on secondhand dealers over the past several legislative terms. This legislation may serve as an opportunity to make those much-needed revisions. The bill was referred to the House Regulatory Reform Committee.

TAXES

- Broadband exemption: HB 4047, introduced on January 18, would exempt equipment used to provide broadband Internet and data service to customers from the Personal Property Tax. The bill was referred to the House Tax Policy Committee.

- Feminine products: HB 4128–4129 and SB 91–92 were introduced earlier this week and would exempt feminine hygiene products from state sales and use taxes. The bills were referred to the House Tax Policy and Senate Finance Committees respectively.

- Sales tax on trade-in price difference: Legislation that would speed up implementation of sales and use tax on the difference legislation was introduced on Wednesday as SB 94–95 and referred to the Senate Finance Committee. The bill speeds up the phase-in of legislation approved in 2013 that allows car dealerships to only charge sales tax on the portion of the vehicle purchase paid with cash or credit. Previously, dealerships had to charge customers sales tax for the full vehicle purchase, including the portion paid with the value from a trade-in vehicle.

- State collection of city income taxes: Legislation from last term that would allow the state to collect city income taxes on behalf of a city was reintroduced as HB 4029. The bill allows for enforcement, including auditing of individuals, and would allow the Department of Treasury to issue bulletins, directives, guidance and rules. The bill was referred to the House Tax Policy Committee, and MRA will watch it closely to ensure employers will not be adversely impacted by the legislation or rules.

- Textbooks: HB 4028, introduced on January 12, would exempt the sale of textbooks to college students with valid college ID and proof that the book is needed for a class. The bill was referred to the House Tax Policy Committee.

OTHER

- Daylight Savings Time: Legislation introduced as HB 4011 on January 11 would eliminate Daylight Savings Time and keep Michigan on Eastern Standard Time year-round. The legislation was referred to the House Commerce and Trade Committee.

- Homeless Bill of Rights: Legislation creating a “Bill of Rights for the homeless” was introduced as SB 84 on Wednesday. The legislation focuses primarily on the right of individuals to move freely around public property and preventing discrimination that may limit access to public services. The bill would establish a right to emergency medical care and freedom from discrimination in employment due to a lack of a permanent mailing address or having a mailing address that is a shelter or social service provider. The bill was referred to the Senate Local Government Committee.

- Probation/parolee work opportunity grant program: Legislation creating the “Work Opportunity Act” quickly moved through the Senate as part of a larger corrections reform package. The Senate approved the bill on Wednesday 34-1. SB 14 would require the Department of Talent and Economic Development to establish and implement a work opportunity employer reimbursement program to provide grants to employers for hiring individuals on probation or parole. The bill was referred to the House Michigan Competitiveness Committee.

- Retail fraud cost recovery: SB 44, legislation that would allow recovery of law enforcement costs related to retail fraud cases, was approved by the Senate Judiciary Committee on Tuesday. MRA supports the bill, which was reintroduced from last term.