Congress expands protections for pregnant and nursing employees

The 2023 omnibus appropriations bill signed by President Biden on December 29, 2022 contained two amendments aimed at increasing workplace protections for expectant and nursing mothers nationwide.

The Pregnant Workers Fairness Act (PWFA) was modeled after the Americans with Disabilities Act. It requires employers with 15 or more employees to make “reasonable accommodations” (such as limits on heavy lifting or additional bathroom breaks) to known limitations related to pregnancy, childbirth, or related medical conditions. Currently, federal law only requires such accommodations if employers provide them to workers with injuries or medical conditions. Covered employers do not have to comply if they can show that the accommodation would impose an undue hardship on the organization. The PWFA takes effect on June 27, 2023.

The PUMP For Nursing Mothers Act (PUMP Act) expands workplace protections for nursing employees by requiring employers covered by the Fair Labor Standards Act (FLSA) to provide all employees (exempt and non-exempt) reasonable time and private space, other than a bathroom, that is shielded from view and free from intrusion from coworkers and the public to express breast milk for one year following the birth of a child. Previously, this right under the FLSA only applied to non-exempt employees. The Pump Act takes effect on April 28, 2023.

WIC/SNAP changes in February

WIC – Temporary formula substitutes for Similac brand products will end after February 28. WIC encourages them to have adequate inventory of Similac branded formulas prior to discontinuation of the substitute formulas. Contact the WIC office with any issues stocking Similac brand formulas or with any questions or concerns at or 517.335.8937 or mdhhs-wicvendor@michigan.gov.

SNAP – The USDA has officially announced that SNAP emergency allotments, which were implemented as a temporary increase in SNAP benefits (additional $95) during the COVID-19 pandemic, will officially end in February 2023. Benefit payments will return to normal in March 2023.

MLCC will require EFT for beer and wine purchases starting March 31

The Michigan Liquor Control Commission (MLCC) will require retailers to use Electronic Funds Transfer (EFT) for all beer and wine purchases from wholesalers beginning March 31. The commission moved to require EFT payments for all spirits purchases in November 2021. A list of primary contacts for questions or issues with EFT payments at each wholesale company is being compiled and should be available soon.

Winter/spring seasonal spending trends

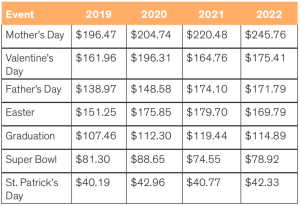

The National Retail Federation tracks expected spend per person for holidays and occasions throughout the year including several winter/spring events worth planning sales and events around. Of the non-winter holidays, moms are generally at the top of the list for spending followed by a near tie between Valentine’s Day, Father’s Day gifts, and Easter celebrations. And don’t forget about tax refunds! While trends have shown consumers using refunds to mostly pay down debt and save, on average, 10% of others look to make major purchases, “splurge,” tackle home improvement projects, or take a vacation.

U.S. Consumer Spending Events (average per person expected spend)

Valentine’s Day 2022 saw $23.9B spent on gifts for partners, friends, pets and more. Top 5 gifts for Valentine’s Day are candy (56%), greeting cards (40%), flowers (37%), an evening out (31%), and jewelry (22%).

For St. Patrick’s Day 2022 celebrations, surveys found that plans included wearing green (80%), a special dinner (34%), decorating their home or office (26%), attending a party at a bar/ restaurant (19%), attending a private party (15%), attending a parade (11%), and hosting a party (10%).

Don’t forget about… tax refunds!

In 2022, a majority of residents expected to file their taxes in February (46%) with 32% filing in March and another 21% filing in April. 59% of them expected to receive a tax refund. Here’s how consumers planned to use their tax refunds:

- Pay down debt 33%

- Savings 51%

- Everyday expenses 26%

- Major purchase 8%

- Home improvement 11%

- “Splurge” purchase 8%

- Vacation 11%

- Other 3%

Deadlines & Reminders

March 2 – Electronic Reporting of MIOSHA Form 300A – Summary of Work-Related Injuries and Illnesses (Establishments with 250 or more employees).

March 30 – Renew food establishment licenses online at MDARD (Current licenses expire April 30).

March 30 – Renew bottled water dispensing machine license at MDARD (Current licenses expire April 30).

April 15 – Renew and print liquor licenses online at MLCC (Current licenses expire April 30).

Monthly reminders:

- Sales & Use Tax – Monthly & EFT – On or before the 20th day of the following month.

- Withholding Tax – Monthly & EFT – On or before the 20th day of the following month.

- Retailer’s Prepaid Wireless 911 Surcharge – Within 30 days of the close of each month. Receipt of a complete Form 5012 is required regardless of payment method.

Quarterly reminders:

- Corporate Income Tax (CIT) Estimated Returns and Payments (Jan. 15, April 15, July 15, Oct. 15).

- Sales & Use Tax – Quarterly & EFT – On or before the 20th day of the month following the quarter (Jan. 20, April 20, July 20, Oct. 20).

- Withholding Tax – Quarterly – On or before the 20th day of the month following the quarter (Jan. 20, April 20, July 20, Oct. 20).

New! Treasury Talk and Your Small Business is a podcast for small business owners hosted by Michigan’s State Treasurer, Rachael Eubanks. Trending topics with Subject Matter Experts will include cybersecurity, tax prep, continuous improvement, economic impacts and inclusion and diversity. Listen for take-aways that will support you and your company here.